Experienced,focused,

patient and disciplined

Altus Capital Partners invests in lower middle market manufacturing businesses across the industrial heartland…that’s been our sole focus since 2003. Our deep experience in the sector provides our investment team with an understanding of the opportunities and challenges faced by founders and senior managers. When we make an investment, we utilize a patient, thoughtful approach that is grounded in our sector expertise while engaging in a collaborative partnership with management teams to help them achieve the growth they seek.

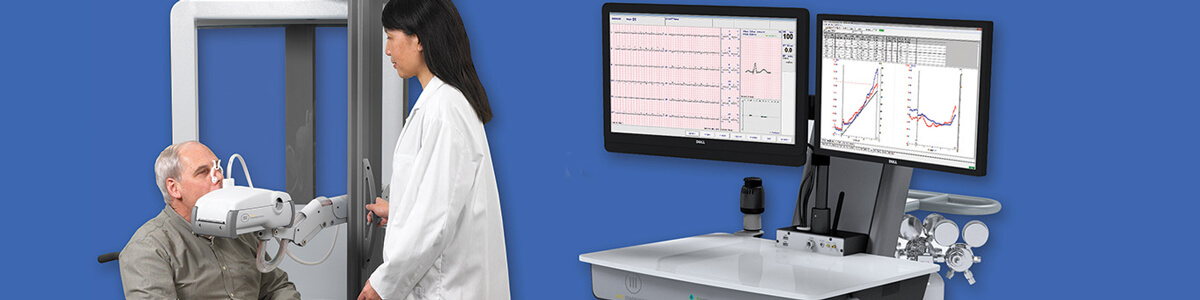

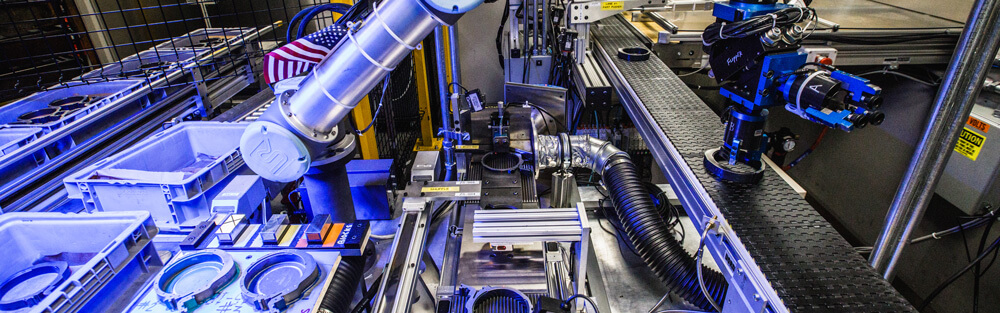

FOCUSED INDUSTRIAL EXPERTISE

We are focused exclusively on investments in lower middle market niche manufacturing businesses. We provide strategic insights and operational support to our portfolio company management teams as they pursue value creation initiatives.

STABLE AND EXPERIENCED INVESTMENT TEAM

Our investment partners have worked together since 1998, putting our capital and sector expertise to work in creating value through the growth of our portfolio companies.

PATIENT, DISCIPLINED APPROACH

We employ a disciplined investment process that thoroughly investigates opportunities and assesses risk and reward. Our goal is the optimal strategic plan.

HIGH INTEGRITY

Altus is not just a source of problem-solving capital, we are an investment firm with high integrity and an investment team that delivers on what they say they will do.

SENIOR LEVEL ATTENTION

The management teams we work with have direct access to our partners and all of the resources they bring to bear.

RELIABILITY OF CLOSE

We have a committed equity fund that provides us with ready access to capital for new platform investments and add-on acquisitions.

Prefferred Characteristics

Transaction Types

Altus typically requires a controlling interest in the companies it invests in, and encourages management to invest alongside us. Transaction types typically include the following:

Altus is interested in manufacturers that serve a variety of industries.