The Altus approachto growth is

to create long-term value

August 25, 2014

Altus Capital Partners Closes Sale of Aqua-Chem

Wilton, CT, August 25, 2014 – Altus Capital Partners, Inc. (“Altus”), a private equity investment firm focused on niche middle market manufacturingcompanies in the U.S., announced the closing of the sale of Aqua-Chem, a global provider of high quality water purification and heat transfer solutions to the military, pharmaceutical, energy, military and bottled water industries was sold to Crimson Investment.

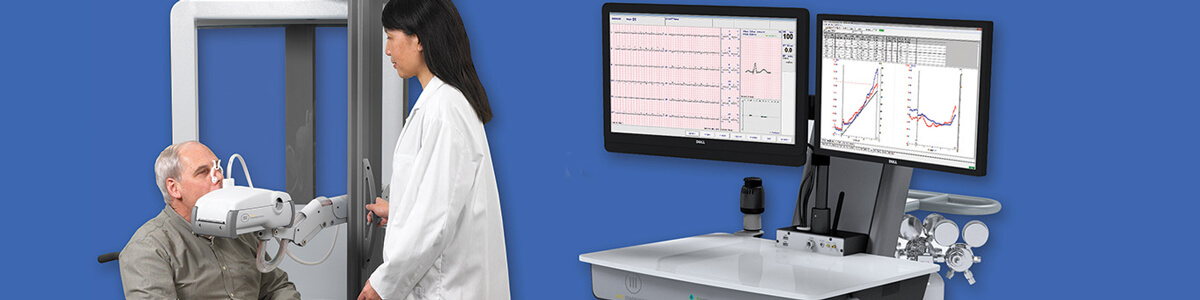

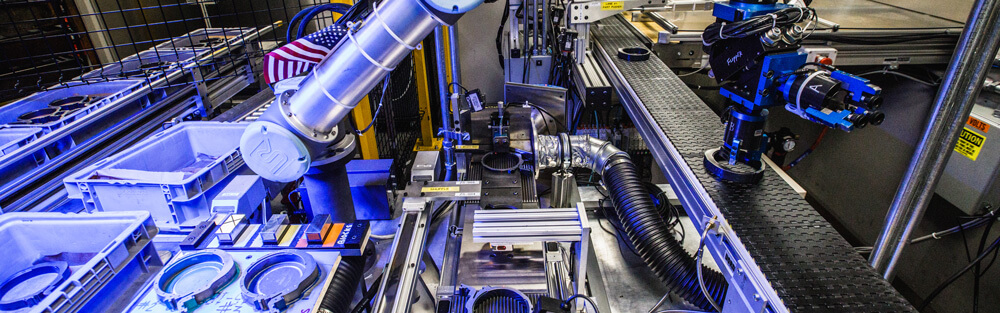

Aqua-Chem was acquired by Altus and Aqua-Chem’s management in March 2006 from The Cleaver-Brooks Company. Since then, Aqua-Chem has expanded into other industrial markets that require high quality water solutions. As part of this market expansion, Aqua-Chem has launched more than a dozen new products, including increasingly large vapor compression systems, reverse-osmosis water purifiers, pretreatment and sanitary process distribution systems, waste heat plate type evaporators, vacuum vapor compression units and titanium and copper-nickel heat exchangers.

Russell Greenberg, Managing Partner at Altus and former Chairman of Aqua-Chem, said, “Aqua-Chem is a prime example of excellence and determination in creating a diversified global company. We want to thank David Gensterblum, the management team and the employees who have worked hard over the past eight years in order to make Aqua-Chem a leader in its markets.”

David Gensterblum, President and CEO at Aqua-Chem said, “We want to thank Russ, Greg, Elizabeth and their team for their time and dedication to help Aqua-Chem grow to become a global water solutions company. We have not only grown as a business but personally during the past eight years and we are grateful to have had a team like Altus behind us every step of the way.”

BB&T Capital Markets represented the shareholders of Aqua-Chem in this sale.

About Altus Capital Partners

Headquartered in Wilton, CT with offices in Lincolnshire, IL, Altus Capital Partners invests alongside management in profitable small to medium-sized manufacturing companies domiciled in the U.S. that have proprietary technologies, processes and products. The Altus investment team is led by three partners who have worked together for over 15 years. In that time, they have acquired 20 platform companies, employing capital and expertise.

For more information on Altus Capital Partners, please visit www.altuscapitalpartners.com.

Media Contact

Laura Brophy

203-331-7618