The Altus approachto growth is

to create long-term value

February 23, 2017

Profiler Talk: Altus Capital’s Heidi Goldstein on a successful investment in rail infrastructure

by Deborah Balshem in Fort Lauderdale

February 23, 2017

Last month, Wilton, Connecticut-based Altus Capital Partners sold portfolio company Rocla Concrete Tie to German rail infrastructure supplier Vossloh.

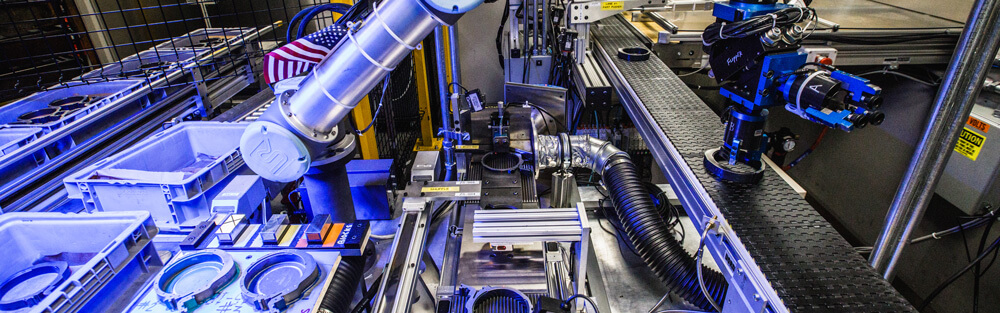

Founded in 1986, Denver-based Rocla manufactures pre-stressed concrete railroad ties and turnout ties for Class I railroads, commuter passenger operations, transit authorities and industrial operations. Major customers include Amtrak, Burlington Northern and Union Pacific.

Mergermarket spoke with Heidi Goldstein, partner at Altus Capital, on how Rocla expanded its customer base, product offerings and physical footprint throughout the US and Mexico via organic and inorganic growth. Goldstein’s full list of deals and relationships can be found here: Goldstein Profiler, download the app here.

For an overview of Altus Capital’s private equity portfolio, please click here.

Significant ROI

Altus, along with Rocla management, acquired a majority stake in Rocla in May 2013. The firm saw the deal as a way to participate in the expected need of high-quality, durable concrete ties that reduce maintenance and prolong rail life within the US and global railroad industry, Goldstein said.

Though Altus typically holds its investments for between four and seven years, that period can differ based on the investment achieving a strong return, as was the case with Rocla, she explained.

Under Altus’ ownership, Rocla doubled its revenue, while Altus realized an estimated 4.5x return on its equity via the exit. Altus typically invests in platform companies with EBITDA of at least USD 4m.

Altus sold Rocla because the company had achieved strong revenue and earnings growth and was receiving strategic interest from multiple parties, Goldstein said.

The firm hired an investment bank to run a limited process, targeting domestic and international strategics “that would understand the capital needs of this business to grow it going forward.”

Ultimately, Vossloh offered favorable terms and efficiency to close, according to Goldstein, who said the sale process was competitive and took approximately five months.

Market Tailwinds

When Altus purchased Rocla, the business was a leading producer of concrete ties in the US with a very strong and seasoned management team. The continued need for domestic infrastructure spend as well as key projects for concrete railroad ties on the horizon enhanced Rocla’s appeal, Goldstein said.

The longer-term trend by railroads is to increase the usage of concrete railroad ties versus wood railroad ties due to concrete’s longevity and ability to support higher speed rail and greater load bearing requirements, she added.

One of the key growth initiatives for Rocla was finding and executing on new projects or acquisitions, so timing was the company’s biggest challenge. “Some of these projects have been in the making for many years, so timing was always uncertain,” Goldstein explained. “When opportunities arose, not only funding, but management capacity was necessary to execute on the growth strategies.”

Rocla’s key management team members continued through Altus’ ownership, so no new executives were added. Goldstein, along with Altus Managing Partner Russ Greenberg and Senior Partner Greg Greenberg joined Rocla’s board of directors.

Strategic Acquisitions

When it sold to Altus, Rocla was servicing customers via three facilities located in Colorado, Delaware and Texas. During Altus’ tenure, Rocla expanded its geography and customer base by adding four new locations through the acquisitions of KSA Limited Partnership and CXT’s Tucson, Arizona facility, as well as de novo facilities in Florida and Mexico.

The acquisition of KSA – a joint venture owned by Pittsburgh-based Koppers Inc., a wholly-owned subsidiary of Koppers Holdings [NYSE:KOP] and Dallas-based Lehigh Hanson – also allowed Rocla to further expand in concrete turnout ties as well as concrete grade crossing, Goldstein noted.

The new facilities and acquisitions were funded by either debt or in some cases debt and equity, according to Goldstein, who said Rocla is the only major consolidator in the US market.

Today, Rocla has manufacturing plants in Pueblo, Colorado; Amarillo, Texas; Bear, Delaware; Portsmouth, Ohio; Fort Pierce, Florida; Tucson, Arizona and San Jose Iturbide, Mexico.

Advisors

On its sale to Vossloh, Rocla used investment bank Robert W. Baird, led by Mike Lindemann and Chris Coetzee, and law firm Benesch, Friedlander, Coplan & Aronoff, led by Joseph Tegreene.

Vossloh was advised by Freshfields, led by Dr. Stephan Waldhausen and Peter Lyons and by BDO, led by Jerry Dentinger and Steven McCullough.

To see full profiles including deals and relationships of each individual involved in this deal, download Profiler app, available exclusively to Mergermarket subscribers.

About Altus Capital Partners

Altus invests in North American-based niche manufacturing companies that serve a variety of industries with a defensible market position, strong margins and unique products and/or manufacturing processes, as well as an experienced and committed management team that desires to invest alongside the firm.

Goldstein has a key role in several current Altus investments, including International Imaging Materials, a manufacturer of thermal transfer ribbons, barcode ribbons, direct thermal films and fluid inks; MAX Environmental Technologies, an environmental treatment and disposal company; and Nichols Portland, a designer and manufacturer of precision powder metal fixed and variable displacement gears.