The Altus approachto growth is

to create long-term value

March 21, 2017

Rocla, Sleeping Giant

Private Equity International – Deal Mechanic

By Annabelle Ju

Altus Capital Partners expanded Rocla’s freight capabilities to make it a leading rail infrastructure company.

Mid-market firm Altus Capital Partners is a niche manufacturing investor, so when it saw investments in the North American rail industry increasing in 2012, the management wanted to ride that trend.

Its co-founder and managing partner, Russ Greenberg, identifies three market drivers that were important. Onshoring looked poised to bring manufacturing back to the US, and more goods were being delivered by intermodal transportation, which combines rail and road. Also, soaring oil prices had driven a large rise in drilling in new areas of the country, which meant a growth of transporting the fluid by rail.

Railway sleepers – or railroad ties as they are known in its home market – manufacturer Rocla was being sold off in an auction conducted by boutique investment bank CoView Capital. With those drivers in mind, Altus began negotiating and performing due diligence in a process that would take almost a year.

“It took a long time to work through our due diligence questions because the company was transitioning its existing main plant in Denver to its new, larger location in Pueblo, Colorado,” says Greenberg.

The deal was completed in May 2013, when the $200 million Altus Capital Partners II purchased the company from the 1996-vintage CVC European Equity Partners I for $12.4 million in equity, a 5.4x enterprise value to EBITDA multiple.

Average entry multiples for industrial buyouts of this size were between 5.4x and 6.0x in 2013, Greenberg recalls.

Rocla’s management team invested alongside Altus, taking around a 15 percent share.

The CVC fund was in wind-down mode and wanted to liquidate its remaining investments, according to Greenberg.

Rocla was founded in 1986 and at the time of acquisition had manufacturing plants in Colorado, Delaware and Texas, and three major customers: freight companies Burlington Northern Railroad and Union Pacific Railroad, and Amtrak in the transit market. Expansion had stalled under the previous ownership, but Altus believed Rocla had potential to grow as its industry grew.

“We had been looking for an investment opportunity in the rail infrastructure space where we could work with a quality management team and help them build out their business,” Greenberg says.

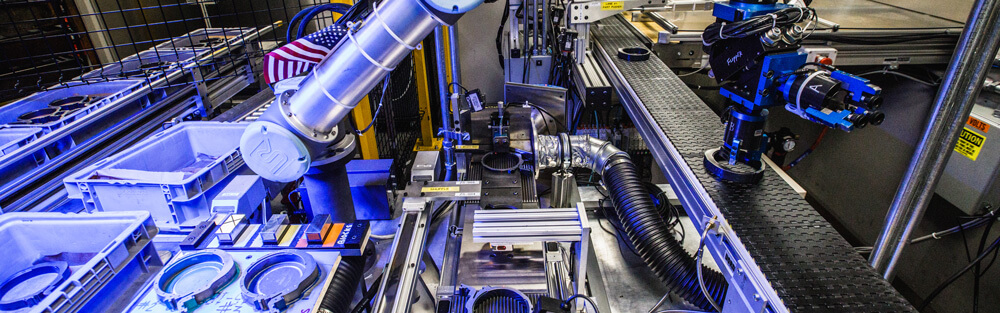

1-MAXIMISING MANUFACTURING

Immediately after the deal closed, Altus invested a further $5.4 million to expand and meet the customer needs at the plant in Colorado. Altus and the management team also worked to secure a contract to build a plant in San Jose Iturbide, Mexico, and another in Fort Pierce, Florida.

Altus’s investment capital also supported two add-on acquisitions: Ohio-based railroad manufacturer KSA, and an Arizona-based plant from fellow manufacturer CXT.

“We needed something in the Midwest to fill out that part of the country to serve more customers,” Greenberg says. “A concrete railroad tie weighs about 750 pounds apiece. Rocla was producing close to two million railroad ties a year. That’s a lot of tonnage to transport, so you want to be closer to your customers.”

2-PRIORITY ON PERSONNEL

Part of Altus’s strategy is to keep the existing management team of a portfolio company and require it to invest alongside its fund. The team had been constrained by the previous owners, Greenberg says.

“Our investment thesis was to back its management team, who had been stifled under its prior ownership from spending capital for growth,” he says.

The firm also raised more than $15 million of debt capital to fuel the growth in capacity and new plants.

The overall headcount at the company grew organically as it added plants and bought competitors, and the senior executive level stayed the same.

The firm did, however, bring in two outsiders. It hired Kirk Feuerbach, the chief executive officer of Altus’s former portfolio company DS Brown, which manufactures rubber, steel and concrete products, as an operating advisor in 2013. The same year, Robert Rayner, who had sat on the boards of several US-based manufacturing companies and served as president and chief operating officer of cement company Essroc, joined the board.

“Kirk and Robert assisted the management team in terms of strategic discussions, determining execution risk and helping the management with additional advice where needed,” says Greenberg.

Altus stayed heavily involved with strategic planning, quarterly meetings and capital approvals for the company.

3-CREATING NEW CUSTOMERS

The plant Altus helped build in Mexico allowed Rocla to sign up Kansas City Southern Railway Company’s Mexican subsidiary as a client.

According to Greenberg, half of Kansas City Southern’s revenue comes from its Mexican operation and it wanted to have a concrete tie supplier in the country to meet its needs. Rocla also added Florida-based real estate and railways company CSX Corporation and Alberta-based Canadian Pacific Railway to its customer base, more than doubling the customers in the freight market.

Freight customers make enormous orders compared with smaller transit clients, Greenberg says, and about 70 percent of Rocla’s sales come from the former. The expansion drove a growth in revenue to $88 million when Altus exited.

Having not made a rail investment before, Altus had to become comfortable with the cycles inherent in the industry. Activity depends on new projects or replacing existing infrastructure, rather than linear growth.

“The demand can be volatile,” Greenberg says. “That’s the challenge, understanding the degrees of customer demand.”

***

In summer 2016, when Rocla had the largest market share in North America, it was approached by several strategic buyers.

Altus hired investment bank Robert W Baird to co-ordinate discussions with potential buyers. The sale closed with Germany-based rail infrastructure supplier Vossloh Group on 4 January, generating a 57.3 percent gross internal rate of return and a money-on-money multiple of around 4.5x.

“We had achieved our goals in terms of growth and value creation,” Greenberg says.