The Altus approachto growth is

to create long-term value

April 18, 2011

Meet the Manager: An interview with Greg Greenberg, Altus Capital Partners

PrivateEquityCentral.net

Greg Greenberg, cofounder of Altus Capital Partners, is passionate about the importance to the U.S. economy of the middle-market manufacturing companies in which his firm invests.

PrivateEquityCentral.net: Could you give us some background on Altus Capital Partners?

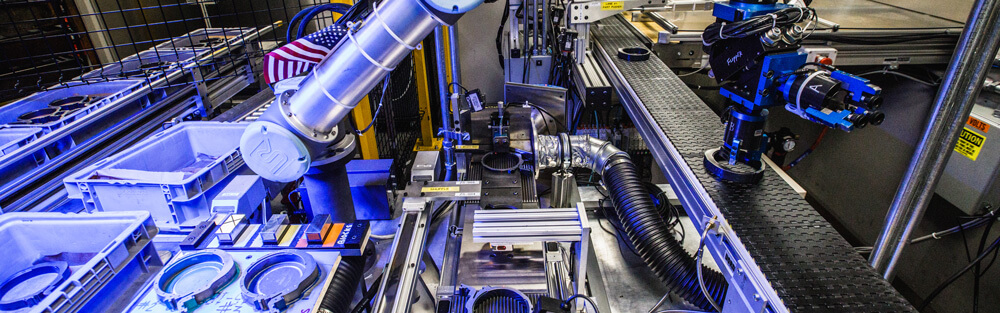

Greg Greenberg: We are a leading private equity investment firm focused on niche middle-market manufacturing companies in the U.S. We have just completed the investment period for Altus I at the end of 2010. In Altus I, we made eight portfolio or platform acquisitions and we have exited four of those. We have now started investing Altus II. Altus II was targeted at $200 million fund to continue the same strategy as the first fund.

Specifically, [our investments] are companies that provide a highly engineered product.

PEC: What do you mean by “highly engineered?”

GG: What we mean by that is that the product commands a high degree of customization; companies that are solution providers.

PEC: Could you give us a specific example either of a company currently in your portfolio or one that you recently exited?

GG: We can talk about our most recent sale, D.S. Brown which is a company that manufactures highly engineered bearings and expansion joints for elevated highways and bridges in North America. Each state has unique requirements for how their bridges and elevated highways are built. A bearing is the component that goes between the vertical column and the horizontal member which allows an elevated highway or bridge to move if it needs to. That bearing is highly engineered to meet specific state regulations for safety, functional attributes, the structural element, as well as the aesthetics.

PEC: When did you make the original investment?

GG: We made the investment in D.S. Brown in August 2008 and we just completed the sale April 1. In the 28 months of Altus’ ownership of the company, working in conjunction with management, we were able to increase D.S. Brown’s revenues 35% and its EBITDA 133%.

PEC: How did you do that?

GG: When we were evaluating the investment in August 2008, as part of our due diligence we establish our investment thesis. That included that we saw an opportunity here to realize significant growth through executing on three initiatives. One was increasing capacity because they were running at capacity. The second was enhancing and elevating the operational efficiencies within the plant. Third, was expanding the product offerings.

PEC: Isn’t this the opposite of the public image of private equity where it’s usually felt that the private equity partner comes in and rather than expand, they want to take apart the company for their own investor needs?

GG: Some firms may do exactly what you say. Our focus is, when we make an investment in a business, we make it on the investment thesis that we don’t want the business to stand still. We want to execute on initiatives to grow the business by either supporting the management team organically or through add-on acquisition. When we’re looking at a business, we’re embracing the management team and we act as partners.

PEC: You made that particular investment right on the cusp of the financial crisis, when there were already signs that there were problems ahead. Did you make this investment thinking that there might be more government support of infrastructure?

GG: When we were looking at this, the lending markets were getting very shaky, tentative; people were pulling back. But through our due diligence, it was evident that the highly degteriorated state of roads and bridges in North America was accelerating, which meant that there would be a need for repair. While we knew there was talk about new stimulus money, our going into the deal was independent of the stimulus money. In fact, D.S. Brown’s growth has very little to do with stimulus dollars, because they went for patch-and-repair of asphalt, not for structural components and improvements. But we were able to identify that, in North America there were various funding sources that would fund on a state and federal level, even in the absence of stimulus. Money would be spent because it had to be. The negative ramifications from a macro-economic standpoint if we didn’t repair our roads and bridges — if we couldn’t use them, think about the spillover.

PEC: What are other types of companies that Altus is focused on?

GG: The common element with all the investment makes is that there is a manufacturing component. We don’t do just service companies or distributors. They are highly engineered businesses in a broad array of industries. For example, staying in the infrastructure space for a minute, we have AquaChem, a manufacturer of water purification and desalination equipment. That’s a business that we invested in 2006; we’ve supported that management team in completing three add-on acquisitions.

There’s another business in the building products space, Thermofiber, an investment we made in 2007. We made that investment on the premise that we will be going into a declining commercial market in 2008. We did that because we identified this is a company that has tremendous brand recognition and a strong management team. However, the current ownership had cash-starved them, so they couldn’t execute on some initiatives to realize growth. So we put in additional capital to modernize the facility which allowed for increased capacity, but, at the same time, greater efficiencies. We cut costs as a result of that modernization program. We enhanced its environmental compliance in the industry. This business has performed extremely well during a horrific commercial market.

PEC: I assume that they were already positioning themselves to take advantage of the green building revolution, but did you push them further in that direction?

GG: Yes, that was one of the attractions — that their product was at a high degree of recyclable content. But they weren’t selling that feature. So we helped them a lot with their sales and marketing. While they were known; they weren’t known as much for their green attribute.

PEC: Do you see any new areas you might be looking at right now?

GG: We’ll continue to focus in a broad array of industries, whether it’s aerospace- defense — which we have experience in — building products, industrial processing equipment, infrastructure. But there isn’t a specific area; it’s our special niche.

PEC: Why are you in this particular sector?

GG: We like the tangible aspect to manufacturing. We feel that it’s more defensible versus service businesses; those can be displaced more easily. We feel that manufacturing remains very robust in North America. Meaning that people talked a decade ago about how manufacturing is moving off-shore. But we’ve seen manufacturing 10 years ago go off-shore and then companies came back to North America. Because of the high degree of need of many manufacturing companies for customization; they need to be close to these companies for the design, for R&D and also for them to be a solutions provider. Also, the cost of freight becomes prohibitive.

PEC: Looking forward into what we hope continues to be the economic recovery; how do you think the big picture will affect the space you’re in?

GG: For the overall manufacturing space, globally the U.S. remains one of the leading outputs of total manufacturing dollars. So we’re very bullish on manufacturing for North America. All indicators are that it’s strong. While people talk about manufacturing declining because people are losing jobs, that doesn’t mean it’s declining; it’s just that manufacturing has become more efficient. We have seen general trends of pickup of overall manufacturing the end of 2010, beginning of 2011. There’s continued growth in revenue and earnings for our companies.

PEC: When you’re talking about the type of highly skilled manufacturing, don’t you have a lack of that type of worker?

GG: In some areas of the country, that’s true. We are highly sensitive to that in our investment decision. Customization and design is very critical. But we haven’t had any issues with that [in our companies]. Our focus geographically is the Midwest to the East Coast, down through the Mid-Atlantic and the South.