The Altus approachto growth is

to create long-term value

October 16, 2012

Altus Capital Partners II, L.P. Acquires Gulf Coast Machine & Supply Company

Wilton, CT, October 16, 2012 – Altus Capital Partners, Inc. (“Altus”), a leading private equity investment firm focused on niche lower middle market manufacturing companies domiciled in the U.S., today announced that Altus Capital Partners II, L.P. along with members of management has acquired Gulf Coast Machine & Supply Company (GULFCO), a leading provider of value-added forging solutions to energy and industrial end markets.

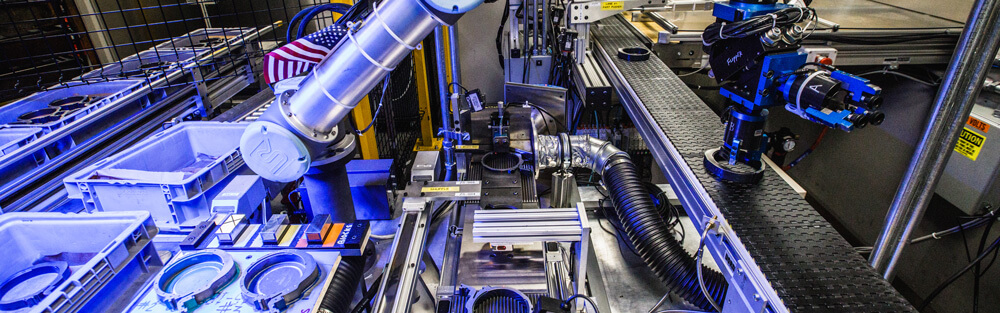

Founded as a small machine shop in 1919 and based in Beaumont, TX, GULFCO’s specialized equipment and highly skilled professionals offer advanced ring rolling, open die forging, machining, heat treating, and testing for products formed into seamless rolled rings, discs, bushings, blocks, and gear blanks. GULFCO’s unique capabilities have positioned it as a preferred supplier for blue-chip customers operating in highly demanding environments such as subsea production facilities, refineries, offshore oil and gas rigs, mining machinery, off-highway equipment, hydraulic fracturing equipment, and wind power turbines.

Elizabeth Burgess, Senior Partner, Altus Capital Partners, said, “We welcome the opportunity to work alongside Steve Tidwell and the senior management team in implementing GULFCO’s growth strategy while remaining true to the ideals of customer service and product innovation that have made GULFCO stand out in the markets it has served for more than 90 years.”

GULFCO CEO Steve Tidwell, said, “At GULFCO, we are committed to maintaining our market leadership through a dedicated focus on target markets that larger competitors lack, and a broad suite of manufacturing capabilities that smaller forgers do not possess. Altus’ commitment to U.S.-domiciled manufacturing is demonstrated by their track record. Equally important is their willingness to use their expertise and resources to expand businesses they invest in through funding for internal initiatives and accretive add-on acquisitions.”

Dave Mackin, GULFCO’s President, added, “We are looking forward to a new partnership with Altus to continue the growth of the business as a result of the renewed investment in operations and customer service. With his extensive background in the forging industry, Steve is a great addition to the GULFCO team.”

Tidwell, who recently joined GULFCO, has more than 20 years in the forging industry, including five years as COO of Ameriforge Group.

The GULFCO acquisition is the third in the firm’s second fund, Altus Capital Partners II, L.P., which closed in October 2011 with $200 million in commitments.

About Altus Capital Partners

Based in Wilton, CT with an office in Lincolnshire, IL, Altus Capital Partners, Inc. invests alongside management in profitable small to medium-sized manufacturing companies domiciled in the U.S. that have proprietary technologies, processes and products. The Altus investment team is led by three partners who, in 17 years of successfully investing together, have acquired 23 platform companies.

For more information on Altus, please visit www.altuscapitalpartners.com.

Media Contact

Rosalia Scampoli

Marketcom PR

212-537-5177, Ext 7