The Altus approachto growth is

to create long-term value

October 12, 2011

Altus Fund II comes in at $200 million

PE Hub

www.digitaljournal.com

Altus Capital announced today that it closed its latest fund at $200 million.

The Westport, Conn.-based lower middle market firm had targeted $160 million for Altus Capital Partners II LP. The pool closed yesterday, says Russell J. Greenberg, the firm’s managing partner. Investors include large U.S. pension funds, fund of funds and other institutions.

Mercury Capital Advisors and Sparring Partners acted as placements for fund II.

Marketing for the pool was faster and easier that Altus’ prior fund, says Greenberg. Altus’ last fund, Altus Capital Partners I LP, raised $80 million in 2003. The pool was an SBIC fund and Altus received $50 million from the SBA, plus $30 million from private investors. Because Altus I was an SBIC fund, Altus needed to have co-investors for each of the eight deals it did, Greenberg says. “Fund II won’t require co-investments,” he says.

Altus I produced a net IRR of 32.4%, Greenberg says.

Fundraising for Altus I took one-and-a-half years while the second pool was completed in 13 months, Greenberg says. “I’m very pleased with the breadth and quality of investors in Altus II,” he says.

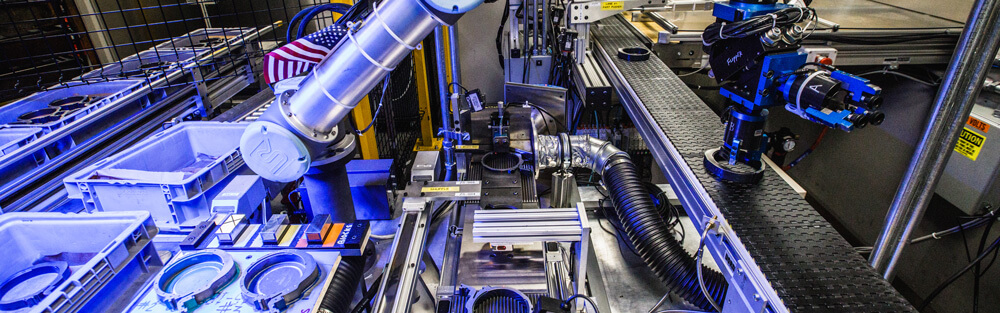

Greenberg and his brother Greg, along with Elizabeth Bergess, founded Altus in 2003 (altus means ‘enhanced’ in Latin, by the way). The firm targets manufacturing companies with $5 million to $12 million of EBITDA. Such a focus helped the firm in fundraising, Greenberg says. Altus got “good traction” with institutional investors, because “it had a good track record and a demonstrated ability to help portfolio companies improve shareholder value,” he says.