The Altus approachto growth is

to create long-term value

October 12, 2011

Altus closes sophomore fund at hard cap

Dow Jones LBO Wire, By Hillary Canada

Altus Capital Partners closed its second middle-market buyout fund at its $200 million hard cap after about 13 months on the road, according to Managing Partner Russ Greenberg.

The firm was targeting $160 million for Altus Capital Partners II LP, more than twice the amount it raised for Altus Capital Partners SBIC LP in 2003. Limited partners in Altus’ debut fund consisted primarily of high net-worth individuals and family offices. This time, in addition to returning investors, the firm brought on some institutional investors.

One of the other key differences is that Fund II was not structured as a small business investment company.

“As an SBIC fund we were limited as to how many dollars we could put into one company,” said Greenberg. That meant that most deals required co-investors. With Fund II, the firm can write more sizeable checks on its own.

It will also aim to invest in ten to 12 companies in the next three to four years. Fund I did eight deals, four of which have already been exited. Greenberg said those four exits averaged a five-times gain on equity invested.

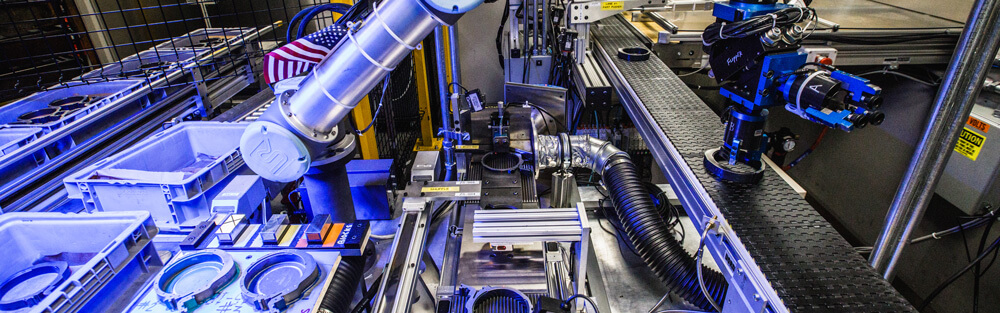

The Westport, Conn.-based firm focuses on domestic manufacturers with enterprise values of between $30 million and $100 million and a minimum of $5 million of earnings before interest, taxes, depreciation and amortization. Greenberg said the firm expects to close its first deal from Fund II within the next thirty days.

Reach Altus at 203-429-2000.

http://www.altuscapitalpartners.com