The Altus approachto growth is

to create long-term value

October 10, 2011

Altus Capital wraps up second fund

The Deal, By Taina Rosa

www.pipeline.thedeal.com

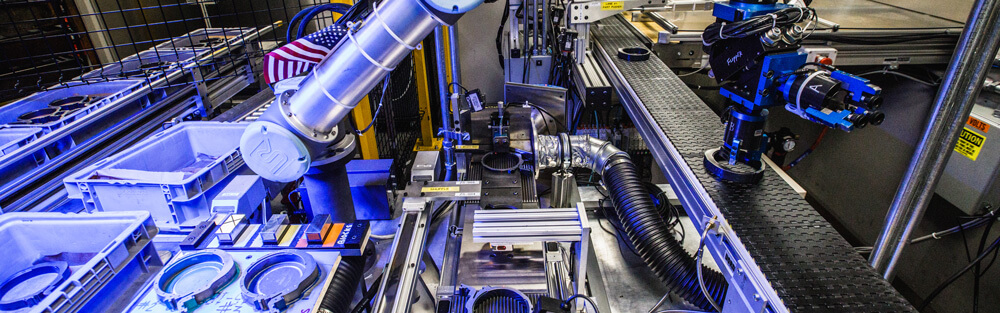

Private equity firm Altus Capital Partners Inc. has closed its second fund with $200 million in capital commitments, the firm said Thursday, Oct. 13. The vehicle surpassed its $160 million target, the firm said. Westport, Conn.-based Altus invests in U.S. manufacturers with proprietary technologies and highly engineered products. Mercury Capital Advisors Group LP and Sparring Partners served as placement agents to the new fund. The latest fund, Altus Capital Partners II LP, will seek to make 10 to 12 platform investments. Altus targets companies with an enterprise value of $30 million to $100 million, and a minimum Ebitda of $5 million. Altus launched its first fund in 2004. According to London industry tracker Preqin Ltd., private equity funds raised an aggregate $44.8 billion in the third quarter of 2011, down 46% from the previous quarter.